YNAB Your best personal finance app

Review and steps for beginners on the personal finance app - You Need A Budget

Why YNAB but not any other budget app?

YNAB - a short form for You Need A Budget - started off in 2003 by a couple, Julie and Jess. Like the rest of us, they feel a need to know "what little money we had very closely". We picked YNAB in the first place as we see a similarity in our budgeting philosophies! We started with trial account and then learned how it transformed our spending pattern. Believe it or not!

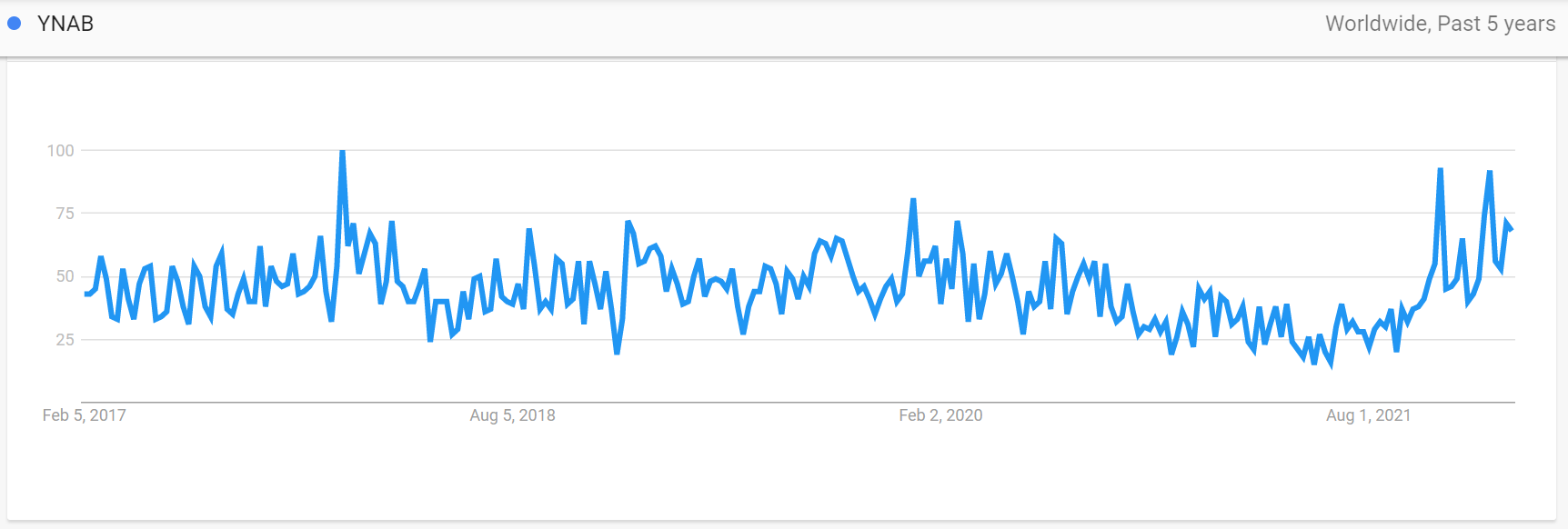

The search volume of YNAB surges over the years, indicating that the budget app has been a trend as it brings a whole new world of possibilities of expenses tracking, expenses categorizations, and budget allocation. When we first approached the platform, it was a bit overwhelming and it eventually took me a few months to get familiar with the functions. We would therefore love to share with the folks new to YNAB our learning curve.

Steps for beginners with YNAB

- Define your budgeting objectives - be it paying off your debt, or managing a budget with your partner. YNAB first addresses your pain points and thereby introduces a series of help from relevant case study sharing to class on account set up. I am always the big spender and on the contrary, she takes a more conscious approach to spending. So, we decide our saving objective to be purchasing our first flat.

- As YNAB takes a forward thinking approach to budgeting, every dollar is assigned a "purpose" prior to actual spending. Create categories as detailed as possible. For us, we track both our own expenses and our co-expenses and categories are largely in common. Here are the categories - transport, books, eat & drink, eat & drink at work, shopping, groceries, entertainment, hair cut, medical, sports, cosmetics, gifts, music, phone, others, stupid error (yes it's not a typo). A little piece of reminder here is the more categories you record, the more effort you put into data input, the more elaborative your data analysis is in future.

- Next, set up all accounts where your money outflow and inflow are and input the starting balance. Some examples are bank account, wallet/cash, credit card, investment account. Again, the more you include, the more precise you know where the money goes.

- Regardless of if you manage the budget on your own or share the same saving pace and goals with your partner, decide on the monthly budget assigned for each category at every month end.

- From here, you can set the ball rolling! Input all your income and expenses on each category and from each account. I was a little doubtful at this practice of inputting even tedious amount in the first place, and sometimes the amount was so small that you overlooked the entry. You will soon realize it's important to input every spending record as it involves reconciliation process at the next step. If it happens that your expenses exceed budget, you have a choice to reallocate budget from one category to another (revisit point #3). We insist on avoiding re-allocating money in certain main categories to avoid overspending.

- At the end of the month, some hard work needed here. Cross check the balance of all accounts (as listed in point #3) are correct - i.e. all transactions are recorded (this reconciliation can be done in more often basis)

- Review the monthly spending and get the answers for where you spent the money on most and take this into consideration for budgeting next month. You are then ready to manage your budget for next month. Run through the steps from point #4 to #7 again.

- Last, we look at yearly reports together and this is the most rewarding and exciting moment as we see it as a little competition between us to find out who is the "big spender" of the year!

The set up procedure requires some thinking, but you can always modify your categories, accounts and budget as you move on. For me, I recall struggling for the 2 to 3 months and establishing the habit of recording my expenses in great detail. By looking back at the record of the past 5 years, I am grateful for building this budgeting habit with her (my all-time CFO) and making progressive improvement in spending/saving and how we are working towards our goal of buying a flat. Sign up here for your free trial and experience YNAB's systematic way of budgeting.